Increasing the Value of a Multi-Unit Business

By Founders Advisors

Jan 07 2020

By: Mike McCraw

For high-growth multi-unit concepts, such as restaurants, fitness studios, and entertainment venues, access to institutional capital through partnership with a debt or equity partner is often critical for streamlining operations and strategically expanding to new locations. Whether owners are looking to grow, recapitalize, or sell, select metrics are commonly evaluated by institutional lenders and investors. Built from our interactions with hundreds of middle-market investors each year, Founders’ Financial Readiness Assessment gives an overview of the indicators we see having the greatest impact on multi-unit business valuations.

Founders Financial Readiness Assessment

- Same Stores Sales Growth – Historical proof, beating expectations and franchisor benchmarks

- Financial Preparedness – Consistency of reporting, ability to analyze at lower levels, GAAP

- Average Unit Volume (AUV) – Diversification of revenue mix, length of sales cycle, size of transactions

- EBITDA Margin – Exceeding peer/industry benchmarks, ability to sustain, room for growth

- Gross Profit Margin – Accurately categorized costs, level of dependence on end market, ability to control

- Cash on Cash Returns – Control over buildout costs, success of marketing, ability to meet debt services

- Per Person Average – Ability to increase wallet share, success of sales initiatives

- Management Team – Understanding of weakness, delineation of responsibilities, low levels of turnover

- Site Selection – Ability to secure high-traffic, high-visibility locations with attractive lease terms

- Technology Integration – Effectiveness in minimizing disruptions and adapting to consumer preferences

- Process Documentation – Consistency of franchising process, employee onboarding, retention strategies

- Talent Retention – Retaining key management through profit interests, incentive plans, and stay bonuses

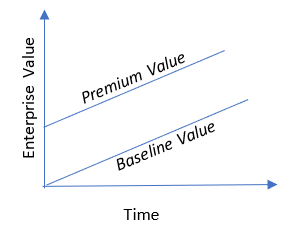

Whether preparing for a recapitalization or outright sale, improving key performance metrics can help unlock a premium valuation for multi-unit businesses.

Same Store Sales (SSS) Growth

Why It’s Important

A simple yet important metric, SSS growth allows for top-line comparison both across years and between existing locations.

SSS growth can help gauge customer retention, the effects of new products or pricing initiatives, and the relative impact of a unit’s geographic location and/or management team.

SSS growth gives insight into whether a geographic location is “saturated,” and therefore, whether to open new locations in the area or invest in existing units. It’s important to determine if an increase in SSS is due to an increase in customers, or an increase in amount spent per customer.

What Investors Look For

In early-stage multi-unit businesses, sales growth is driven by new unit openings. However, any geographic location will eventually reach a saturation point, so investors look for business models that can produce organic growth over the long-term.

Sales growth (or lack thereof) can be heavily influenced by each industry’s overall growth, but the following can be used as a general rule of thumb for SSS expectations:

Early-Stage: >15%

Mid-Stage: 5-15%

Mature: 1-5%

How to Improve

- Set quarterly and annual expectations and track against these benchmarks.

- If SSS growth is meeting or exceeding expectations, product demand is sufficient and owners should consider opening new locations.

- When diagnosing sales growth problems, collect specific customer feedback to understand their decisions to buy or not to buy.

Financial Preparedness

Why It’s Important

While financial preparedness may seem like an ambiguous standard, it is important to evaluate when considering whether a company will gain interest from institutional capital providers.

No matter how attractive a company’s operations or products may seem on the surface, if its books are not reliable, trustworthy, and consistent, it could be overlooked or even dismissed entirely.

Being financially prepared can significantly reduce the amount of time and money spent on pre-investment “due diligence.”

What Investors Look For

Internally, being financially prepared means having defined roles and responsibilities for the financial department. Depending on size, a company may need just a bookkeeper, or it may need a bookkeeping team, inside accountants, financial analysts, and/or a chief financial officer.

Externally, institutional investors look for stamps of approval in the form of professional accounting reports. Ranked in terms of “trustworthiness,” a company’s financial statements can be compiled, reviewed, or audited.

How to Improve

- Have clearly documented accounting procedures that are followed consistently on a weekly, monthly, and annual basis.

- Hire a 3rd party accounting firm to perform monthly and annual financial audits.

- Though private companies are not required to use generally-accepted accounting principles (GAAP), following these procedures will provide the most financial statement visibility and allow for easy comparison to industry peers.

Average Unit Volume (AUV)

Why It’s Important

Average Unit Volume, which is typically reported on an annualized basis, measures the amount of top-line earnings brought in by a location. This allows for earnings comparisons across locations and between years.

While AUV is useful for revenue comparisons, it does not reflect the profitability or overall success of a business. For example, a highly-trafficked urban location paying premium rent costs may generate a higher AUV but end up less profitable than a lower-volume location.

What Investors Look For

Institutional investors are looking for businesses with minimum AUVs around $1.0mm. Highly successful locations – such as large restaurants, health clubs, or retail outlets – can average $3mm – $5mm per location.

Investors also prefer businesses with consistent, predictable revenue streams on a monthly basis, which are typical for restaurants and subscription-based models such as fitness clubs.

High-growth AUVs across multiple geographic locations demonstrates a repeatable, in-demand concept.

How to Improve

- Targeted marketing campaigns, special deals, and pre-opening membership sales can help a unit to open with a higher baseline AUV. This helps owners to better understand realistic growth expectations past the first year.

- If a unit is generating above-average AUV but low profitability, investments should be considered to streamline processes and cut costs.

- Expanding the physical capacity of a business by adding extra space, tables, chairs, etc., should be considered if demand is sufficient and it does not materially impact profitability